| Applications | |

Semantically rich 3D building and cadastral models for valuation

The current valuation practices in various countries are analyzed: Turkey, United Kingdom, USA, Germany, and the Netherlands. The (possible) role of semantically rich 3D building models and 3D cadastres in relation to valuation and taxation is explored |

|

|

|

|

|

|

|

|

|

|

Valuation of real estate/ properties is in many countries/ cities the basis for fair taxation. The property value depends on many aspects, including the physical real world aspects (geometries, material of object as build) and legal/ virtual aspects (rights, restrictions, responsibilities, zoning/development plans applicable to the objects spaces). The aim of this study is to investigate the opportunities provided by the semantically rich 3D building and cadastral models for valuation and taxation. In this paper we investigate the following related aspects:

1. Relationship between physical real world objects and legal (virtual) objects,

2. Use of (semantically rich) 2D and 3D descriptions of both physical real world objects and legal (virtual) objects for valuation, and

3. Maintenance of the 3D information.

Background on building and cadastral models and data

Building models (physical objects)

The representation of physical buildings with digital building models has been a subject of research since four decades in the fields of Construction Informatics and GeoInformation science. The early digital representations of buildings mainly appeared as 3D drawings constructed by CAD software, and the 3D representation of the buildings was only geometric, while semantics and topology were out of modeling focus. On the other hand less detailed building representations, with often focus on ‘outside’ representations, were also found in form of 2D /2,5D GeoInformation models These models contain geometry and linked semantic information in compliance with the feature model of the GIS domain (as explained in ISO 19125-1). Since the start of 2000s, detailed models containing geometric, topology and semantic information have began to emerge with the advent of Building Information Models.

Isikdag & Underwood (2010) defined Building Information Modeling as “the information management process throughout the lifecycle of a building (from conception to demolition) which mainly focuses on enabling and facilitating the integrated way of project flow and delivery, by the collaborative use of semantically rich 3D digital building models in all stages of the project and building lifecycle”. From this same perspective a Building Information Model(s), i.e. BIMs can be defined as “the (set of) semantically rich shared 3D digital building model(s) that form(s) the backbone of the Building Information Modeling process”. These models are capable of containing geometric/semantic information regarding the building indoors and outdoors, in a very high level of detail (i.e. models can be regarded as LOD, or LOD N models), where a model in some cases contain the geometry/semantics of nut & bolt or a picture frame in the house. The complexity of the BIMs (in terms of object relations) is very high and furthermore as the population of the entity instances (i.e. the data) of the model increases, it becomes costly to store and perform advanced queries on the models. Another model that is found valuable in 3D representation of buildings, has its roots in geoinformation modeling. A well known schema of GML (an OGC standard which is developed mainly for the exchange of geoinformation), namely CityGML (OGC,2012, Gröger and Plümer, 2012), offers digital representation of models in different levels of details, LOD 4 of the model offers possibilities of indoor representation. As explained by OGC City Geography Markup Language (CityGML) Encoding Standard (2012), “Buildings may be represented in LOD0 by footprint or roof edge polygons. LOD1 is the well-known blocks model comprising prismatic buildings with flat roof structures. In contrast, a building in LOD2 has differentiated roof structures and thematically differentiated boundary surfaces. LOD3 denotes architectural models with detailed wall and roof structures potentially including doors and windows. LOD4 completes a LOD3 model by adding interior structures for buildings. For example, buildings in LOD4 are composed of rooms, interior doors, stairs, and furniture.”

Land administration (legal/ virtual objects)

Land administrations systems (land registry, cadastre) have different origins in different countries. The information was sometimes collected for taxation purposes and in other cases for legal security. Over the years, in many countries the land administration systems more and more served both applications; e.g. in the area of spatial development or spatial planning. In this context the term multi-purpose cadastre is used. Based on the initiative of the FIG (International Federation of Surveyors), ISO has developed the standard Land Administration Domain Model (LADM), ISO 19152:2012. In the standard, land administration is described as the process of determining, recording and disseminating information about the relationship between people and land (or rather ‘space’). The LADM standard defines a basic administrative unit (‘basic property unit’) as an administrative entity, subject to registration (by law), or recordation, consisting of zero or more spatial units (‘parcels’) against which (one or more) unique and homogeneous RRRs (rights, e.g. ownership right or land use right, responsibilities or restrictions) are associated to the whole entity, as included in a land administration system.A parcel can be described by 2D or 3D geometry or even by textual descriptions (Lemmen at al, 2010). Homogenous means that the same combination of RRRs equally apply within the whole spatial unit. Unique means that this is the largest spatial unit for which this is true. Making the unit any larger would result in the combination of rights not being homogenous. Making the unit smaller would result in at least 2 neighbor parcels with the same combinations of rights. The objects (parcels) are called legal or virtual objects, because they do not need to be visible in the real world. However, it should be noted that quite often the boundary of a parcel coincides with a physical real world object; e.g. a fence, wall, edge of road. In case of 3D parcels, this is even more true; e.g. the geometries of physical objects such as tunnels, building (parts) or other constructions correspond also to legal spaces with unique and homogeneous RRRs attached. Perhaps valuation is not directly a 3D cadastre topic, but is it strongly related, because most property tax systems are one way or the other based on an assessed value of the property and relevant in context of multi-purpose cadastre.

Relationship between physical and virtual objects

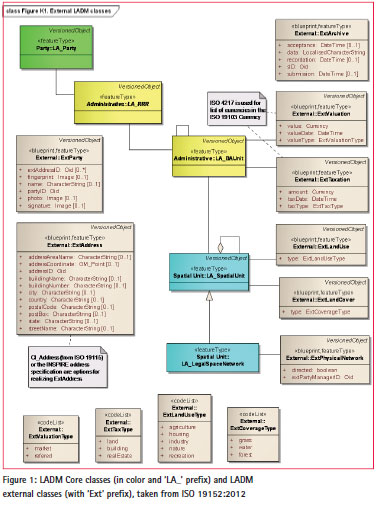

A (3D) building registration is something else than a (3D) Cadastre. Cadastre is about the legal spaces. That is, spaces described by geometry (and topology) where certain rights, restrictions or responsibilities (RRRs) are attached to. So, all kinds of building details, such as different rooms/ spaces, may not always be relevant (when same RRRs apply). Only when the RRRs are different then also a separate geometry is needed. So, most likely only a part of the indoor building modeling information may be relevant in 3D Cadastre context (and perhaps that geometry is even implicit; e.g. a 3D boundary defined by the ‘middle of the wall’). The geometries of the real world (physical) objects and the geometries of the legal objects should be consistent and we should design rules for this. Further, one could argue that when in a certain jurisdiction one has the responsibility to pay certain amount of tax based on the function/ type of a room/ space in a building, then this would fall under the definition of a legal space. This will further reinforce the link between 3D cadastre and building models. The Annex K from ISO 19152 (Figure 1), is a UML diagram showing in color core classes of the LADM standard: green, LA_Party (person), yellow, LA_RRR (right, etc. such as ownership)/LA_BAUnit in blue, LA_SpatialObject (parcel) and showing not in color the LADM external classes (with stereotype <>, e.g. ExtTaxation, ExtValuation). LA_BAUnit stands for basic administrative unit, a group of LA_SpatialObjects with same RRRs attached. LA_SpatialObject has several specializations, such as LA_ LegalSpaceNetwork (shown in diagram, including link to ExtNetwork, the physical network registration) and LA_ LegalSpaceBuildingUnit (not shown in diagram, but could be linked to physical building registration). LADM is more a conceptual framework defining concepts and terminology, than prescriptive standard. A country should first develop an LADM country profile supporting the legislation of the country (and described in concepts of the international standard), before transforming this into a land administration implementation.

Valuation in various countries

In this section we will analyze the various valuation approaches and the role of 2D/3D geometries in countries such as: Turkey, United Kingdom, USA, Germany, and the Netherlands The section is concluded with a short analysis on the potential use of 3D geometries for the purpose of valuation.

Turkey

There are 2 different types of valuations. The first one is regarding the sales of the properties to calculate the market value, and the second one is valuation for taxation. The two types have many similarities in calculations and some small differences.

Determining the Market Value

The first type is called Real Estate Appraisal or Real Estate Valuation. In Turkey, experts in this field work as ‘government certified valuation experts’. There are 3 commonly used methods for determining the market value of the built properties:

a) The first one is comparison with a reference sales price approach. This method includes finding a set of similar properties, comparing the attributes of the property-in-focus with these similar properties and estimating the value of the property.

b) The second method of valuation is income approach; e.g. such as rent. There are several techniques in use with this approach.

c) The third method for valuation is the cost approach. When this approach is used the value of the land lot needs to be calculated separately and added to the value of the building, in order to find overall value of the property. There are also several techniques in use with this approach. The land lot valuation uses “total floor area” based valuation for residential buildings, and “total building volume” based valuation in industrial buildings by using zoning parameters such as Building Coverage Ratio (BCR) and Floor Area Ratio (FAR) and HMax (maximum allowable building height).

Determining the Taxation Value

The valuation for the purpose of taxation is accomplished by local or greater municipalities in Turkey. The valuation of the houses and flats are determined by valuation commission of the municipalities. The tax is known as the property tax. The law regarding the property tax is Law No. 1319. The regulations that explains how the taxation value of the house would be determined, is dated 29.02.1972 as Cabinet Council Decision 7/3995. As mentioned in Bal (2014) according to this regulation there are 3 methods for valuation.

a) First one is comparison method. This method is similar to the first approach of market value determination. The similarity between the property in focus and other properties that the sales prices would be compared needs to be similar in terms of 1. use (Residential, Office, Other Specific Building), 2. building construction type (Steel Framework, Concrete Framework, Stone, Stone Frame, Timber, Shanty, Sun-dried / Mud Brick), 3. building quality (Luxury, Class 1, Class 2, Class 3, Simple Construction) and 4. comparison factors (proximity to businesses/ parking/ gardens/ schools/ public transportation/ seafront/ main road; existence of urban infrastructure: gas, electricity, sewerage; dimensions of the property, number of rooms; comfort, elevator, heating/ ventilation/ air conditioning; landscape that can be viewed).

b) The second method of valuation is income method. This method is much simpler than the similar approaches presented in section for market valuation. The Annual Gross Income is calculated as Average Annual Rent that can be earned in the neighborhood of that property. The value of the property is then determined as: Asset Cost = Annual Gross Income x 10.

c) The third method is costing method. When this method is used the value of the land lot needs to be calculated separately. In this method the value of the property is calculated as follows: Asset Cost= Gross Floor Area x Unit Cost with Unit Cost= Cost of 1 sqm. of the building based on its building type, use and quality. The Unit Cost charts are published and distributed by the Ministry of Finance every year. In the current practice neither the facade areas of the buildings nor the floor plan areas are derived from the digital building models, in addition the factors such as having heating/ ventilation/ air conditioning are not checked using the models. It is foreseeable that the efforts towards the use of 3D semantically rich building models for valuation would be beneficial for the process. From the viewpoint of the comparison approach it will definitely provide opportunities for better comparison based on factors listed. From the viewpoint of the costing approach, the use 3D models will form a basis for preparation of detailed and accurate costing (e.g. using quantity surveying method), in addition the floor level also has an impact on costing for taxation.

United Kingdom

In the UK the valuation of the houses are done by the UK Government Valuation Office Agency, mainly for forming the base for Council Tax calculation. As explained in Valuation Agency (VOA, 2014) ‘Understanding your Council Tax Banding’, the Council Tax in England is a local tax based on what a home would have sold for at a fixed point in time:1 April 1991. The income from council tax is collected by local councils to help pay for local services. The table below shows the range, based on 1 April 1991 values, for each band in England. Each year, the local council sets the level of council tax and can tell you the amount payable, for each band.

Valuation Band Open Market Value as at 1 April 1991

Band A Not more than £40,000

Band B £40,001 to £52,000

Band C £52,001 to £68,000

Band D £68,001 to £88,000

Band E £88,001 to £120,000

Band F £120,001 to £160,000

Band G £160,001 to £320,000

Band H More than £320,000

In UK taxation scheme a property is defined as “A separate unit of living accommodation, occupied by the same person(s) and within the same area of land, comprises a ‘dwelling’, together with any garden, yard, garage or other outbuildings attached to it. In tax calculations each property is allocated to one of the eight bands, A to H, (‘A’ being the lowest) according to its national value on 1 April 1991. As explained by VOA, the agency takes account of the size, age and character of the property as well as its location when allocating a council tax band. This allocation of a band is in fact a valuation of the property with a very limited accuracy and referring to market data around 1 January 1991. For council tax, the basis of measurement for all houses and bungalows is the building’s gross floor area, including wall thicknesses. This will include bay windows, chimney breasts etc., but will generally exclude areas with headroom under 1.5metres (e.g. under sloping ceilings in attic rooms).

The basis of measurement for most flats and maisonettes is net floor area with measurements taken between the wall surfaces of each room (not skirting boards). Bathrooms, WCs and associated lobbies, as well as connecting corridor areas within a flat would not usually be measured. As with houses, areas with headroom of less than 1.5 meters will be excluded. Individual properties might need to have their banding re-considered when:

• A house decreases in value because: 1. part of it is demolished, 2. substantial changes take place in the local area (for example a new road is built nearby), or 3. alterations have been carried out to make it suitable for use by a person with a physical disability.

• The owner starts or stops using part of your home to operate a business, or the balance between business and domestic use changes.

• A home gains a higher value because a previous owner has carried out major improvements, such as building an extension.

• A self-contained unit is built, such as an annex to house an elderly relative.

• A house has been split into individual flats, or flats have been merged into one home.

A banding is also done for different kinds of self-contained units. A selfcontained unit is a building or part of a building constructed or adapted to make it capable of forming a separate unit of living accommodation. This could be, for example, an annexe for an elderly relative, or adjoining properties knocked through, and occupied as one unit, but retaining essential facilities of two. Common examples of properties that are identified as self-contained units are: 1. Annexes, or ‘granny’ flats, often designed and built for elderly relatives, 2. Accommodation for wardens in student accommodation. 3. Previously separate but adjoining houses/ flats now occupied as one residence, 4. Former servants’ quarters in large houses.

In summary the valuation in UK is had been done implicitly by the government in 1991, hence the role of the use of 3D information is not clearly identified in UK valuation process. Newly constructed properties are also assigned a nominal 1991 (2003 for Wales) value and banding. Also the banding is reconsidered when a property is changed as mentioned. For banding newly constructed properties and changes in banding the Valuation Office Agency needs recent information of the property on type, size, age and location. A 2D or 3D model can help presenting these data to the Valuation Office Agency. Although explained in government documentation the exact (rules) of the valuation (such as explained in the former section regarding Turkey) are not explicit and made publicly available. Local authorities set a council tax rate and value based on the banding of the property.

Next to the banding system for residential properties in the UK the non residential properties are valued every five year for the business rates. For these business rates the rental value of the property is valued by the Valuation Office Agency. For these business rates the Valuation Office Agency not only needs information on newly constructed (non residential) properties and information on changes, but also information on all properties for the periodical revaluation. However the 2015 revaluation is postponed to 2017 to save costs.

USA

Property tax in the USA (Wikipedia USA, 2014) has a long history, and was already well established in most of the then 15 states, by 1796. We will discuss property tax in the US, with regard to real estate, as opposed to cars or certain business property or inventories. In contrast to other forms of tax (including property tax on aforementioned nonreal- estate), real estate property tax will generally not cause (unexpected) budget shortfalls – at least in theory. The process is such, that revenue equals tax levy, except, presumably, for significant economic, political, or other disruptions, between assessment and payment:

• Fair market values are estimated, throughout a respective region. Multiplication with a local assessment ratio (such as 0.96) yields individual assessed property values vi. (Assessment ratio may vary between categories, such as residential, farming, etc.).

• Contests of assessment may lead to “corrections” in individual assessed values v’i.

• Known required total revenue r and all known corrected assessed values v’i (plus exemptions, credits, etc) allow subsequent derivation of a required local tax rate (which may also vary between categories, possibly even distinguishing between inhabited and vacant buildings). This yields assessed tax, for each individual property. It also yields the required total revenue, apparently quite reliably. There are, of course, political, economic, and legal constraints: some local rules may limit individual yearly property tax increases. Similarly, political and economic considerations result in similar constraints.

Implementation of valuation, assessment, and values of assessment ratio and tax rate vary significantly across USA counties, cities and school districts, also depending on the legal framework set up by state legislation. Local jurisdictions can levy overlapping property taxes (within potential state regulations). Revenue tends to be used for school districts and other local expenses. States and the federal government generally do not tax real estate property, but the resulting income and capital gains.

Despite significant local variations, property taxes are generally based on some measure of fair market value, multiplied with a local assessment ratio and a tax rate. When a property has recently been traded between unrelated parties, then that transaction value serves as fair market value, for some period of time. Beyond that, the fair market value has to be assessed, to some degree subjectively, by an assessor. Preferential treatment might be given to certain property categories (such as farms, non-profit organizations, etc.) or businesses the government would like to specifically attract. Also, fair market value may be determined, based on actual, or based on optimal use. Residential and farm property tend to be more likely to be assessed, based on actual use, than some other real estate categories. Many local rules allow for homestead exemptions, such as exempting the first $50,000 of primary residences from property tax. Valuation techniques tend to be based on:

• Recent sale transaction between unrelated and non-compelled parties.

• Otherwise, sales of comparable properties, based on similar:

– Type, use, and size.

– Location.

– Improvements (features, materials, style, amenities, even existence of a fixed kitchen island, or number of power sockets). Owners may avoid certain forms of development to limit assessed values. This has been recognized as an issue, leading to a separate consideration of land and improvements.

– Desirability, proximity to schools.

– RRRs. In order to reduce assessed values, owners may sometimes ask to have rights restricted that they do not plan to exercise, anyway.

– Economic conditions.

• Otherwise, original or replacement cost, minus depreciation.

• Or, if applicable, income generating ability.

In the USA the valuation to market value and assessment for taxation purposes is (nearly) always done by using statistical modelling using multiple regressing types of models.

It would be hard to represent local rules and variations, and subjective judgment, in even a sophisticated 3D building model or cadastre. However, statistical models may yield local parameters, beyond mere assessment ratio and tax rate. A limited number of common concepts, plus several local correction factors fi may model local variations, successfully.

Applicability of 3D Building Models and 3D Cadastres

Due to the many aspects that can affect assessed values in many USA locales, 3D building models and cadastres seem to be great potential tools to support the computer assisted appraisal models (CAMA) and assessment of properties, as well as communication to the public.

Some very detailed aspects, such as wooden floor, number of power sockets, and fixed kitchen islands, used in the appraisal models appear to require very rich 3D models, with a combinatorial explosion of complexity. It should be possible, though, to limit the models to aspects common to many locales, as opposed to local idiosyncrasies. Any aspects not in common use, any subjective or only loosely defined concepts could be represented as SPECIAL_CASE_ FACTOR or SPECIAL_CASE_OFFSET in various strategic areas of a global model. A homestead exemption of the first $50,000 of a property value could be modeled with the same formula as a local rule that only taxes the first $100,000 of improvements, to reduce sprawl. We may not have to explicitly model all the many different concepts, individually, by name.

Germany

Property tax in Germany (Wikipedia Germany, 2014) has been uniformly regulated, since 1938. In the context of the reunification in 1990, property tax in the new states (“east”) has been adapted and merged into the federal system, with some differences remaining between old (“west”) and new states. Property tax in Germany (Grundsteuer) is similar to the equivalent in the US, in many ways. There is a property value (Einheitswert), multiplied with a factor (Grundsteuermesszahl) similar to the USA assessment ratio. Multiplied, they yield the Grundsteuermesswert, similar to the USA assessed value. Multiplied with a tax rate (Hebesatz), they yield the assessed tax (Jahresgrundsteuer).

Semantically, however, there are differences:

• The Einheitswert is not a fair market value, but a federally standardized value proxy. This is similar to a USA county that would estimate assessed values, based on building and land square footage, local population density, type, use, and income generating capabilities, alone. It does not aim to reflect actual market value, and only reflects relative market value differences between multiple properties, very approximately. A neighbor A with a property of slightly lower market value than neighbor B might nevertheless end up paying slightly more in property tax. Large distortions are very unlikely, though, particularly considering local building codes and other restrictions. When comparing non-neighboring properties in far-apart locations, relative distortions of Einheitswert compared to market value may increase. This is less relevant, though, due to the different tax rates in such far-apart locations.

• The Grundsteuermesszahl is federally determined, not locally (such as the USA assessment ratio). This does not limit local flexibility, though, since setting the tax rate, locally, allows all the flexibility needed. Similar to the assessment ratio, also the Grundsteuermesszahl varies, depending on property type.

• The Hebesatz, similar to the USA local tax rate, is determined, locally, and can vary, depending on property type. Numerically, both Grundsteuermesszahl (given in ‰) and Hebesatz tend to have significantly different value ranges than their equivalents in the US. The concepts are otherwise quite similar, though. The fact that the Einheitswert is not the real market value and is multiplied with two hard to understand percentages might make the property tax in Germany less intuitive. Many homeowners may primarily remember the fairly static amount due, and ignore the complicated underlying math. For the more technical purpose of modeling property tax, complexity should be similar to the US, though.

Similar to the USA:

• German property tax is considered very predictable revenue, since it is guaranteed by the property value, and the current owner, personally. In case of sale, the new owner can also be liable for the property tax the old owner has not paid. The new owner will thus verify that there is no such remaining balance.

• Individual properties can be exempted from property tax, such as to attract business, protect historic buildings that generate little to no income, etc.

• Exceptions similar to homestead exemptions exist.

• Local governments receive the revenue of the property tax.

• Property tax is determined for land and buildings, separately.

• Current use, as well as potential use, and RRRs, can affect property tax. An owner might request (not necessarily successfully) to further restrict their RRRs, yielding a lower property tax.

Applicability of 3D Building Models And 3D Cadastres

The current property tax in Germany, despite its similarities to the USA system, would not depend on quite that much detail in a 3D building model or cadastre. Many aspects, such as wooden floors or granite countertops have no bearing. Many of the more conventional aspects of 3D models and cadastres, such as RRR, though, could be very useful in modeling German property tax.

The Netherlands

For the valuation for market purposes, for instance for sales and other types of real estate transactions in the Netherlands there is no specific regulations. Certified appraisers working in this field can use Cadastral information on RRR. For the valuation the appraisers also need information on object characteristics. They have to collect these characteristics of the object to be valued themselves. A very limited part of these data can be derived from the Key-register for buildings and addresses in the Netherlands. However the appraiser is responsible for the accuracy of the data he is using on building year and area of the property. Therefore mostly he collects these characteristics himself, for instance by measuring the property using construction drawings. Also the certification scheme for certified appraisers is a responsibility for the market parties involved. There is no official regulation for the skills of the private certified appraiser.

The valuation and assessment of real estate for government purposes is regulated by the Act for Real Estate Assessment (in Dutch: “Wet Waardering Onroerende Zaken (WOZ)” (http://wetten.overheid. nl/BWBR0007119). English translation: http://www.waarderings-kamer.nl/ default.aspx?sec=content&id=1064). The assessed value in the Netherlands is therefore called “WOZ-value” of a WOZ-object. The WOZ-object is a built or not built real estate property, a part of a real estate property (when this part is used by a tenant and is a separate (lockable) unit with all facilities) or a complex of properties (owned by one person and used as unit by one user).

Since 2007 the valuation of all properties (WOZ-objects) is done every year and on real market value. For the valuation the appraiser looks back one year, so the assessed value for the year 2014 is based on the real estate market on 1 January 2013. For all residential properties the valuation is made using the methods of comparable sales. Because of the number of properties to be valued (about 7.5 million residential properties and 1 million non residential properties each year) techniques for mass appraisal are used with computerized valuation models. For non-residential properties the valuation is based on income approach (using information on market rents) or cost approach (base on actual investment in building project of coarse taking into account depreciation for older properties).

The WOZ-value is important because it is the basis for a number of taxes in the Netherlands. The municipalities levy a real estate tax. For residential property the owner pays around 0,1 to 0,2 % of the assessed value as a yearly tax to the municipality. The rates for non-residential properties are mostly higher and for non-residential properties the user of the property pays tax as well (the owner occupier of non residential properties pay twice). But the municipality can also levy other taxes based on the WOZ-value, for instance a sewer tax). Polderboards in the Netherlands (other type of local government in the Netherlands that take care for ‘dry feet’ even when a large part of the country is below sealevel) also levy a property tax from the owner of the property as a percentage of the assessed value. On national level the central revenue office uses the WOZ-value for levying income tax, inheritance tax, corporation tax and more.

The municipality is responsible for the valuation and this is checked at national level by the Council for Real Estate Assessment (in Dutch: ‘Waarderingskamer’). The municipalities (in 2014 403 municipalities) often use the services of companies to perform the actual valuation or cooperate to be able to have highly specialized staff for the work. A large part of the work is collecting and updating the data for the valuation models. For collecting and updating data we distinguish:

• Market data. Municipalities get all sales prices out of the national keyregister for cadastral information. Municipalities collect themselves information about properties on the market (internet advertisements) on rent prices for commercial properties like offices and shops and building costs of specific properties like schools, hospitals and industrial sites.

• The legal (and planning) status of the involved properties or in LADM terminology: the RRRs. The municipality finds the legal information in the key-register for cadastral information, but because of the regulation in the Act for Real Estate Assessment primarily information about the owner of the property is important. Planning information is derived from the municipal zoning maps.

• Object characteristics. Most of the information on type, and size of properties, building years, quality of materials, quality of facilities within the building, maintenance condition etc. is collected and updated specifically for the valuation and assessment. Use and updating information on building year and size of property is often done in connection with the key register on buildings (also a municipal responsibility) and the key register for large scale base maps. Collecting and updating information is mostly not done directly in the field, but is done in the office using recent (yearly) aerial photographs and street view type of images (cyclorama’s). The information in the pictures is transferred into administrative object characteristics as type of building or grade for maintenance condition, because only these administrative object characteristics can be used in the automated valuation models.

For change detection automated techniques are used for comparing aerial photographs for consecutive year or comparing aerial photographs with existing digital maps. In practice nowadays there is only limited direct use of 2D geometries, mostly because size of property and type of building can not be derived from these 2D models. However there is an intensive use of 2D aerial photographs enriched with streetview images. One can imagine that semantically rich 3D models in which the surface of buildings is shown with picture images, will not only help to automatically detect comparable building (at comparable locations), but also help the appraiser updating object characteristics for the valuation models.

Applicability of 3D Building Models and 3D Cadastres

Combining the appraisal with 2D or 3D geometry also can help to convince the owner of the property that the municipality has made a reliable assessed WOZ-value for his property base on accurate object characteristics. In the near future, the WOZvalues for residential properties must be publically available in context of a fair and transparent government. A web-based WOZ-viewer will be introduced, not only showing the value of a single property, but also the values of the surrounding properties. In the first phase this will be presented using 2D geometries (user can choose between map or aerial photographs). But in case of apartment complexes and some other configurations it can be hard to select a property within a 2D geometry and 3D geometries may be needed.

Analysis

From the above valuation cases we learn that current valuation practice are primarily using administrative data for the valuation models. Models that use 2D or 3D geometries directly for valuations are not yet implemented in practice. However 2D and 3D models are becoming more and more important for updating the information within the valuation models and for presenting valuation results with the underlying data to for instance the owners of properties.

It can be expected that when 3D geometries are available and can object based be combined with object characteristics a growing number of systems for computer assisted mass appraisal will get possibilities to use these characteristics in conjunction with the geometric data on size, location and comparability.

Improve valuation possibilities in the future

With the realistic expectation that in the near future up-to-date and semantically rich 3D building models and 3D cadastres will be realized and data accessible via SDI, the future valuation may become significantly more efficient and flexible. The effect of this would differ by country, since some valuation/assessment procedures are more resource consuming than others. On the efficiency side, a uniform (file/database) data source and automated analysis should clearly offer improvements, compared to currently usually manual information aggregation and personal judgment, often “in the field”.

Also, it is not clear that assessment would necessarily be solely based on measures or proxies of market value. There already are many exemptions, separate assessments of land and improvements, assessment ratios and tax rates that differ by locale, type, and use, all of which expressly deviate from property tax being proportional to value. Sometimes income generating ability of either property or owner are taken into account, sometimes not. A retired owner of a (historic) castle may be more successful pleading for property tax exemption than the retired owner of merely an above-average house. Clearly, there is an interest in taking parameters into account that are unrelated to value, but clearly can be modeled in 3D building models or cadastres. Uniform handling and implementation of such factors is not only fair, but also allows the government to more effectively achieve the intended policy goals (of either favoring or disincentivizing various concepts).

New 3D representations should be investigated as well. Typically buildings are represented by BIM, e.g. Industrial Foundation Classes (IFC) (MSG, 2007)) or CityGML. The two standards have different concepts, i.e. they represented the building structure from two distinct views: the constructor (IFC) and the user (CityGML) view. Which model is more appropriate to be used for property tax is further to be studied in detail. IFC models provide many details but are still not that commonly used. In contrast, CityGML LOD1 and LOD2 exist for many cities all over the world. LOD1 and LOD2 however represent only the outer shell of the building and have no interior information. Ongoing research suggests that outdoor LODs can be automatically enriched with interior information.

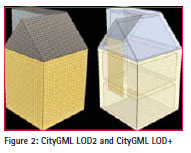

Boeters 2013 has shown in this research that LOD2 can be extended with information about floors and thickness of the walls and slabs. The research was performed on request of the Municipality of Rotterdam, the Netherlands. The goal was to compute the internal net area (i.e. the area that can effectively be used), which is used amongst others also for taxation. The Dutch standard NEN 2580:2007 (NEN 2580, 2007) and later BAG (Fuld, 2007) provide guidance how to compute the net internal area. The two documents differ in some of the specifications, but these differences have been not properly reflected in the registration of internal net area. To check these values for the entire city of Rotterdam, CityGML LOD2 models were extended automatically to LOD2+ (LOD2 + interior floors). LOD2+ was reconstructed with knowledge about number of floors (from BAG) and assumptions on the thickness of walls and floors (related to the year of construction). Figure 2 shows the original LOD2 and the extended LOD2+. The applied approach was tested for one neighborhood in the City of Rotterdam. Although the approach is not very accurate (due to many assumptions and lack of information), the comparison between the computed LOD2+ and the registered net internal area, have shown interesting results. For the majority of the buildings the net internal area was smaller than the registered values available in BAG (73.4 %). The net internal area from the LoD2+ model was 16% smaller than that registered in BAG. Further investigations of the results, have clarified that the most of the differences come from the area under the gable roofs. According to BAG, areas with a roof less than 1,5m have to be subtracted from the net internal area (Boeters 2013).

This research has clearly shown that 3D representations can support mass computation of net area and consequently facilitate taxations of properties. The representations should not necessarily be very detailed, which allows for uniform automatic approaches.

One might argue that 3D building models and cadastres for property tax excel at taking objective factors into account, but devalue the art of personal judgment. This is not necessarily true, since subjective factors or offsets could easily be modeled (though they may reduce automation). But one might also object that factors that can be formalized may ultimately enjoy higher legitimacy, anyway.

Conclusion

Despite the fact that analyzed valuation cases in the selected countries are primarily using administrative data for the valuation models, it was argued in this paper that models that use 2D or 3D geometries directly for valuations would have some significant benefits. However, for fair annual valuations, it is clear that the used models and data need to be up-to-date.

There is the debatable question of who should be allowed to update authoritative 3D building models and cadastres, based on which processes, and yielding which level of accuracy or reliability. Who should pay for it? Would volunteered data sets be included? Digital signatures authenticating each update may be useful. But in general we can say that in the future, owners of property, but in general “the crowd” will play a greater role in keeping information up to date and this can also help updating functional 3D data systems. It might also be possible to assign levels of confidence, for each update. Any automated assessment analysis on top of such data may be able to derive an overall level of confidence for the resulting assessment. Prior to changing the formula to derive property taxes, officials could first query, what level of confidence is currently assigned to the existing data the new formula would be based on. Instant and virtually cost-free analysis of feasibility can presumably only benefit policy decisions.

References

Hasan Bal .(Ed.) (2014), SPK Gayrimenkul-Konut Degerleme Uzmanl, Gazi Kitapevi, 2014.

Roeland Boeters, 2013, Automatic Generation of CityGML LOD2 models with interiors and its suitability for net internal area determination, MSc Thesis Geomatics, Delft University of Technology, p. 138,

http://www.gdmc.nl/publications/2013/ Automatic_enhancement_CityGML.pdf.

Fatih Döner, Rod Thompson, Jantien Stoter, Christiaan Lemmen, Hendrik Ploeger, Peter van Oosterom and Sisi Zlatanova (2011). Solutions for 4D cadastre – with a case study on utility networks In: International Journal of Geographical Information Science, Volume 25, 7, 2011, pp. 1173-1189.

Marthe Fuld. Key Registers for Addresses and Buildings. Presentation, September 2007, http://wiki. geonovum.nl/images/BAG_EN.pdf. Gerhard Gröger and Lutz Plümer, 2012, CityGML – Interoperable semantic 3D city models, ISPRS Journal of Photogrammetry and Remote Sensing, 71:12–33, July 2012.

MSG 2007, Industry Foundation Classes, IFC2x Edition 3, Technical Corrigendum 1, Online documentation, http://www.buildingsmart-tech.org/ ifc/IFC2x3/TC1/html/index.htm.

Umit Isikdag and Jason Underwood (2010). A Synopsis of the Handbook of Research on Building Information Modeling, In Proceedings of CIB 2010 World Building Congress http://www.cib2010.com.

Ruud M. Kathmann and Marco Kuijper (2014). Cooperation between taxpayers and municipalities for valuation purposes, Proceeding of FIG conference 2014.

Christiaan Lemmen, Peter van Oosterom, Rod Thompson, João P. Hespanha and Harry Uitermark (2010). The Modelling of Spatial Units (Parcels) in the Land Administration Domain Model (LADM). In: Proceedings of the XXIV FIG International Congress 2010, April 2010, Sydney, 28 p.

NEN 2580 (2007), Oppervlakten en inhouden van gebouwen – Termen, definities en bepalingsmethoden, http:// www.nen.nl/NEN-Shop-2/Standard/ NEN-25802007-nl.htm (in Dutch).

ISO19215-1:2004 (2004). Geographic information – Simple feature access – Part 1: Common architecture. http://www. iso.org/iso/home/store/catalogue_tc/ catalogue_detail.htm?csnumber=40114.

ISO 19152:2012 (2012). Geographic information – Land Administration Domain Model (LADM), version 1 December 2012.

OGC (2012) OGC City Geography Markup Language (CityGML) Encoding Standard, Available online http://www. opengeospatial.org/standards/citygml.

VOA (2014). Understanding your Council Tax Banding, Valuation Office Agency Report. Available from: http://www.voa.gov.uk/corporate/_ downloads/pdf/VO7858_understanding_ ct.pdf [Accessed, 10-09-2014].

Wikipedia USA (2014). http://en.wikipedia. org/wiki/Property_tax_in_the_United_States.

Wikipedia Germany (2014). http://de.wikipedia.org/wiki/ Grundsteuer_%28Deutschland%29.

The paper was presented at 4th International Workshop on 3D Cadastres, 9-11 November 2014, Dubai, United Arab Emirates.

(No Ratings Yet)

(No Ratings Yet)

Leave your response!