LBS MARKET

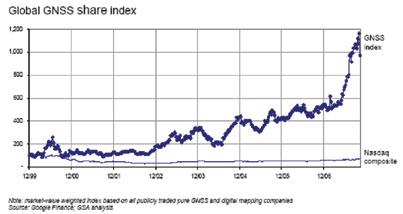

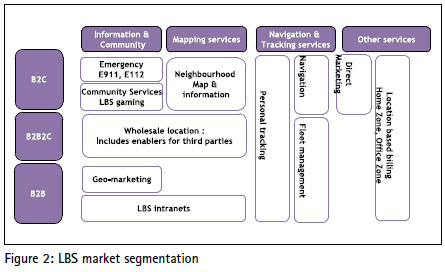

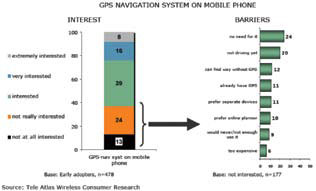

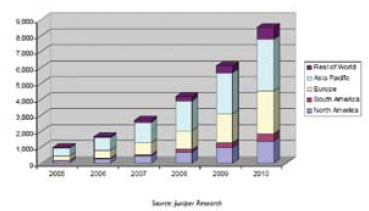

The LBS market has been segmented into 3 main categories: • B2C: Business to Consumer • B2B2C: Business to Business to Consumer • B2B: Business to Business Details of this segmentation are provided in Figure 2. This segmentation highlights the diversity of services that can be offered by an operator. This diversity of services is also a diversity of business model. The LBS market has been especially Figure 1: GNSS industry stock market until 2007 boosted in the past year by the parallel September 2008 | take-off of PND (Pedestrian Navigation Device) market which has enabled the education of the mass market at a large scale. Thus, it is not surprising that, on representative sample of mobile users “early adopters”, one over four find “navigation” on mobile phone, a compelling offer [2], though of course many barriers remain. As another outcome of the survey regarding LBS interest from mobile users early adopters, one over three are very interested in “find the Nearest” services. Thus it is not surprising that the Positionning market expectations for the following years are quite encouraging, as shown in Figure 4 End user spending forecasted for location are quite significant: $4 B in 2008 to over $8.5 B by 2010. And the addressable market for LBS suppliers is around $1.3 B over next 4 years, with highest potential for operators in Asia Pacific & European markets. But these expected success are not granted, and will be driven by many factors:

• standard

• regulatory and socio-legal drivers

• business drivers

• technological drivers

Standard is a key drivers

A. Todays situation

Todays situation, regarding LBS standard, is already the results of years of work in standardization bodies like ETSI or OMA. Control plane standard is available, and mainly used for emergency call Supl V1 was the 1st attempt to standard . This was a good starting point, enabling

open business model but limited for certain application like tracking.

Supl V2, with richer features (Galileo compatible, tracking services compatible) is nearly available (Q3 2008) and enables also open business model. RRLP release 7 is also available, and is compatible with suplvV2, AGPS, and Ephemeris extension. And for the terminal, interfaces between GPS chipset and application are already standardized: NMEA JSR 179. B. … and future challenges This situation has enabled the deployment of first generation of LBS. But today standards are however quite limited, for most of the situation that will be met in the future. How to cover the diversity of :

• wireless network (GSM, GPRS, UMTS, TETRA, WiFi….),

• use cases (fleet management, navigation, geofencing….),

• architecture (network or handset centric),

• available positioning technologies (GPS, A-GPS, WiFi ToA, WiFi finger

printing, UWB, …),

• protocol for the application and services (SuPL, Control Plane, MLP, …) This is why future actions towards standardization bodies shall focus on:

• Handset: o Needs of standard between sensors and/or chipset: (WiFi,

Bluetooth, inertial MEMS, …) blocking advanced hybridisation o Needs of more advanced interfaces between location sensors and application

• Availability of standard on professional wireless network (TETRA, WiMAx). Current standard shall be adapted to the specificity of each network (bandwidth, gateway, …). Example: LIAISON project [1] has

pioneered A-GPS over TETRA

• 3G Long Term Evolution,

• 4G, new social services

Regulatory & socio legal drivers

Regulation can play a strategic role for consolidating the development of LBS. For example , regarding emergency call, different approaches have been adopted all around the world, some of them (like the US E911) being at the origin of the LBS take-off in north America: The US E911regulation is techno agnostic, with: a time frame for the deployment, and performance requirements (accuracy, availability). This has strongly pushed the US LBS market, and the emergence of

performing positioning technologies like Assisted GPS. The equivalent European initiative (E112 regulation) is quite late w.r.t US, and faces many obstacles for a deployment in all European countries, on of the main obstacle being the unclear business model for such specific services. And Japan has put in place an technology driven alternative regulatory approach , that forces the integration of GPS on terminal after April 2007. In the regulatory areas, the next challenges in the future, are:

• Transforming in Europe the chosen flexible approach of E112 into concrete deployment, through nNtional Policy

• Extending E112 regulation to professional wireless network

(WiFi, TETRA, …).

• Favouring the deployment of new performing technologies (like WiMax or UWB indoor technologies) by relaxing some existing constraints: for example, why not authorizing, for emergency

situation, on short period (emergency situation) higher power signals

emissions in certain frequencies?

• Favouring emergence of specific market that could bring strong

added value to the citizens, and will be pushed mainly by regulation: transportation of dangerous good, roach charging. Future regulation in those domain are now feasible, as adequate integrity system like EGNOS are now available all over Europe. It shall be noticed that in most of the market, regulation is not sufficient: “Big Brother” fear remains, and in parallel of regulatory action, there is an obvious need of going on educating the market. Blog dedicated to this goal already exists, as the one targeting LBS for professional market [3].

Figure 3: GPS Navigation system on mobile phones

|

(5.00 out of 5)

(5.00 out of 5)

(5.00 out of 5)

(5.00 out of 5)

(5.00 out of 5)

(5.00 out of 5)

(4.99 out of 5)

(4.99 out of 5)

Leave your response!