| GNSS | |

Necessity of a European strategic plan

In this paper Galileo Services offers an input to the general debate about the role of a coordinated industrial policy to support the European economy and the contribute to the competitiveness of European enterprises |

The concern of the European downstream industry

The justification for the Galileo Programme relies on a two fold objective:

• To achieve independence and autonomy for Europe in relation to non-European GNSSs

• To win a significant share of the huge and continuously growing worldwide GNSS downstream market – the market of technologies, applications and services based on satellite positioning, navigation and timinig

The GNSS downstream market continues to be one of the most promising markets in terms of European growth, with anannual growth rate of the global GNSS market of about +7% per year. The core and the enabled GNSS markets are expected to reach around EUR 110 billion and EUR 290 billion respectively by 2023 (see GSA’s GNSS Market Report 2015).

However, Europe is not gaining an adequate share of this market. The current European share of the global market is approximately 20% – if not lower – compared to a traditional European share of 33% for any other global high-tech sector. Europe’s GNSS market share is even declining. In the mature GNSS applications markets, 80% of well-established market owners are of US origin. Further more, the size and growth of Chinese industry, which has already in just a few years outperformed European industry in the field of telecommunications, is particularly worrying. As things stand, in a few years, it will be difficult or nearly impossible for European Industry to survive in the highly competitive GNSS global market. Unless an effective and long-term strategy is put in place during the Galileo early services exploitation phase (2016-2020), the window of opportunity for European industry to benefit from the current GNSS market boom will soon be closed.

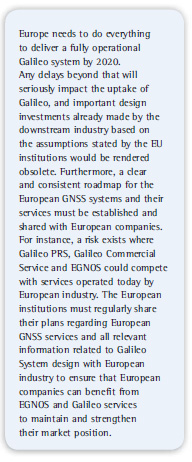

Europe’s goal of achieving GNSS autonomy is also at risk. To have Galileo fully and sustainably operational is indeed a necessary, but not sufficient condition to achieve autonomy. Economic and social dependence on GNSS increases together with the market, and Galileo is just one of three new GNSS solutions complementing America’s GPS: most of the applications do not require four GNSS constellations and GPS, GLONASS (Russian Global Satellite Navigation System) and BeiDou (Chinese Global Satellite Navigation System) are already inplace. GPS is the common standard. Russia has regulated the use of GLONASS in all equipment sold in its territory. BeiDou benefits from a matchless internal market demand in China. Finally, due to the decrease of the industrial base in Europe, much Galileo equipment including critical elements may not be manufactured in Europe. Europe could thus depend on the capacity and strategy of non-European providers.

The targeted European autonomy will be achieved if and only if Galileo is widely used with equipment designed and manufactured in Europe, as well as applications and services developed in Europe.

The socio-economic expectations will be met if and only if European industry succeeds in winning a reasonable share of the global GNSS downstream market. Growth, competitiveness and job creation in Europe must remain the main objective of the European GNSS Programmes. Return of investments–and consequently growth, competitiveness and job creation–can only be expected from the downstream sector.

The industry of GNSS-based applications and services must be placed at the heart of a Galileo-and EGNOS-based economy to ensure a full return of investments in European GNSS infrastructure.

The existing and near operational European GNSS systems, EGNOS and Galileo, offer outstanding possibilities for the downstream sector and could generate significant growth opportunities. However, Europe’s GNSS downstream industry suffers from a dramatic competitive disadvantage vis-à-vis worldwide competitors who have benefited from strong institutional support for decades and have increased their supremacy year after year.

In the US, Russia, China, and Japan, dedicated national strategies exist indeed to support competitiveness of their downstream industry and enhance GNSS market take up, including massive funding for R&D and manufacturing capabilities, regulations and public procurement.

Hereafter are some examples of combined institutional support actions implemented by Europe’s competitors:

• Large and continued military applications R&D programme, which helps to underpin the investments of companies in commercial and civil applications Investments equivalent to several tens of millions of euros for manufacturing capabilities, which supports the development of industry

• Massive procurements equivalent to several billions of euros from the public sector, as anchor customer, which radically boosts private investment

• Regulations, such as giving preference to indigenous GNSS equipment and services

It is crucial for Europe to promptly provide European GNSS downstream industry with the means to become competitive in the global market and create industrial leadership.

The creation or strengthening of European champions able to compete on an equal basis in the worldwide market is necessary.

The opportunities ahead

The game is not over. There are a number of key GNSS applications and services markets – including the most promising services and applications markets in terms of growth potential and strategic markets– in which European Industry must position itself (see Figure 1).

In particular, European equipment and industries have a strong reputation for quality and reliability. The leading position of Europe in GNSS security and resilience domains should be strengthened, as it is critical for today’s and tomorrow’s markets.

There are a lot of unexplored opportunities for GNSS applications and services in Europe.

The potential and capabilities of all global constellations (GPS, Galileo, GLONASS and BeiDou) –leveraging in particular the key European GNSS differentiators (Improved performance, authentication, high precision, robustness and security) also in a multi-constellation environment -offer opportunities that Europe must not miss.

They include:

• Opportunity to develop new GNSSbased positioning, navigation and timing applications and services

• Opportunity to create new industrial activities in Europe and, with them, hundreds of thousands of jobs

A strategic plan to develop the GNSS downstream sector in europe

The European Union must establish a strategic plan aiming at enhancing European GNSS downstream industry competitiveness and fostering European GNSS uptake.

This strategic plan must include an industrial policy in which the public and private sectors coordinate their efforts to develop new technologies, applications, services and industries in Europe.

A comprehensive and assertive industrial policy is essential to develop Europe’s GNSS downstream sector and must aim to:

• Protect and strengthen the existing European industry and foster the emergence of European champions in key GNSS applications and services markets, including strategic domains and domains with significant growth potential

• Support European downstream industry competitiveness and help European companies to gain market share in the GNSS global market

• Foster the design, development and manufacture of European GNSS based technologies, applications and services in Europe

Such a strategic plan must also aim at supporting coordination between existing National or European initiatives to maximise synergy and efficiency, and minimise duplication. Any new support action initiated by the institutions must be consistent with the existing supportactions.

The Commission GNSS Action Plan 2010 to foster the development and adoption of satellite navigation applications using EGNOS and Galileo is a first step in that direction.

Europe can benefit from the particular mandates and skills of its institutions

The role of European institutions in the growth process is especially decisive in times of economic and financial crisis. All stakeholders of the European GNSS Programmes must organise themselves and combine their strengths to give a chance to Europe to take a significant part of this growth and indirectly recover some of the massive investments in infrastructure made by Europe-tax payer money.

European institutions, in particular the European Parliament, the European Commission, the European GNSS Agency and the European Space Agency, must work together and combine their particular skills and competences in a pragmatic way, to guarantee the full success of the European GNSS Programmes from upstream to downstream, and European industry’s competitiveness.

Definition and establishment of a european strategic plan

Purpose of a strategic plan to develop the GNSS downstream sector in europe

European institutions must establish a strategic plan to support the development of a competitive GNSS downstream industry in Europe, building on competitive advantages offered by the European GNSS, and at the same time recognizing multi-constellation opportunities for European industry.

This strategic plan must include an industrial policy to increase European GNSS downstream industry’s presence in the different application markets by defining:

• Clear and quantitative objectives in terms of European industry position in the market with targets in terms of market share, revenue, and job creation or strategic expectations

• Clear support actions from European institutions (e.g. public procurement, regulations) with associated milestones to reach these objectives

• Key performance indicators (KPIs) to assess the achievement of these objectives

An industrial policy includes any kind of action from the institutions that has an impact on the industry (ref. next section). The identified support actions should be shared between the different institutional bodies according to their particular skills and competence.

European institutions can help to mitigate the technology risks, the marketing risks, the financing risks and the regulatory risks. The risks associated with the main market segments should be classified in order to identify the main challenges and threats that market players have to deal with in each segment (currently and in the short, medium and long terms). The assessment of these risks will indicate the nature and the size of the effort required from dedicated institutional actions devoted to the European GNSS downstream sector.

Each time European institutions take an initiative impacting the downstream sector (e.g. to include GNSS in a regulation, to launch evolutions of the European GNSS infrastructure and services), it is crucial to assess at the same time the potential impact on the European downstream players, in terms of competitiveness, business and jobcreation. This must be a major criterion in the decision process.

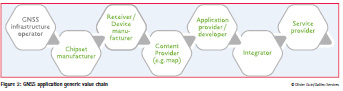

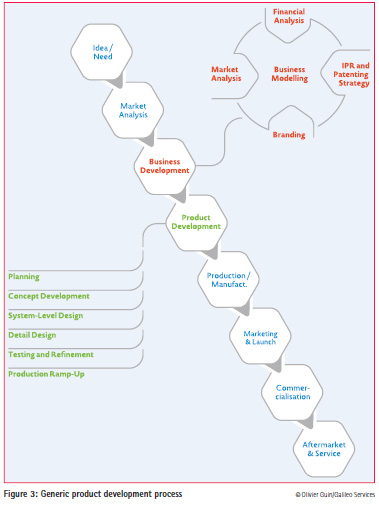

The industrial policy must address each element of the GNSS downstream value chain (see Figure 2) and cover the whole product development process (see Figure 3) so as to enhance the opportunities for genuine European products to emerge.

The first version of such a plan must be established by the start of the Galileo early services exploitation phase (2016- 2020), and must embrace the full duration of the Galileo early services exploitation phase as a minimum.

It must be a multi-annual plan putting actions and targets into the required global perspective.Annual plans must be adjustments to the long term plan to describe detailed actions for the year to come. The five year plan must be revised each year accordingly. From 2021, the future version must align with the financial perspectives of the European institutions and cover 7 years (Multi-annual Financial Framework).

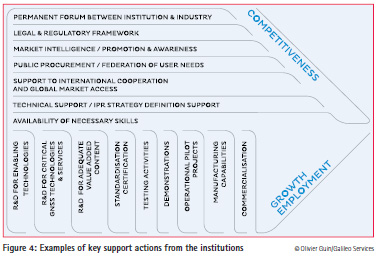

Recommendations on key support actions from the european institutions

A number of key support actions can be undertaken by public institutions to support market penetration and development. Some actions with examples of programmatic instruments/ elements to support the competitiveness of European industry are described below. Note that many of them already exist, but are not always implemented for the GNSS downstream sector.

Galileo Services urges co-ordinated actions in the areas identified in Figure 3. Without these actions, Europe will have funded a GNSS system that will not be used as intended and where the main downstream actors are not European.

Different kinds of actions – legal, institutional, organisational, political or business-oriented – must be undertaken and combined depending on the application domain being considered and the targeted objectives: targets in terms of market share, revenue, and job creation or strategic expectations.

Permanent forum between institution & industry

• Creation of a forum enabling the public and private stakeholders to regularly interact (please refer to section 4 of this paper)

Legal and regulatory framework

• Reinforcement of the regulatory and legal framework to facilitate and encourage European GNSS use in Europe, favouring and incentivising the European GNSS downstream industry, while ensuring that associated standardisation bodies and certification entities anticipate and support industry developments

Provision of market intelligence

• Provision of market analyses and specific business cases allowing identification of opportunities or key markets in which European Industry must position itself: either the most promising service and application markets in terms of growth potential or strategic markets

Promotion & awareness

• Communication actions towards decision makers, procurement agencies and industry to increase their awareness of GNSS applications and services, and of the specific advantages of European GNSS services (e.g. authenticated Open Service, Commercial Service and Public Regulated Service)

• Promotion and awareness raising campaigns to stimulate the take-up of possible users by helping to clarify their requirements (cities, regions, various industrial sectors, etc.) and targeted to promising domains– in terms of window of opportunity and volume – demonstrating European GNSS differentiators and showcasing European industry skills to stimulate European and non-European markets, clarify their requirements and focus procurements

Public procurement & federation ofregional and national user needs

• Large scale public procurement in some key sectors (e.g. critical infrastructure, defence and security) to decrease market risk, support competitiveness, and boost private investment in GNSS technology

• Federation of regional and national needs and coordination of procurement plans for European GNSS products and services at the European level, to create continental-scale markets in Europe and deliver associated economies of scale

• Leveraging on ad hoc take up actions, such as Pre Commercial Procurement (PCP) and Public Procurement of Innovation (PPI) to facilitate the adoption of GNSS solutions

Establishment of user groups

• Establishment of user groups to capture common requirements and develop adequate services to comply with requirements, and avoiding over specifying of services

Establishment of partnership with market owners

• Support to the establishment of partnership with market owners such as MNOs (Mobile Network Operators), infrastructure operators, content providers, or insurance companies, so as to stimulate the opportunities by clarifying the need for European GNSS applications in key economic sectors and there by improve Europe’s competitive position and enhance access to major global markets

Support to international cooperation and global market access

• Carefully establish international cooperation favouring European industry interests, involving non- European partners when providing either opportunities for market penetration beyond Europe’s borders or specific skills and/or technology not available in Europe, and setting up adequate Intellectual Property Rights (IPR) policies

• Support to global market access by providing knowledge on export markets and trade agreements, and by organising trade missions and providing support to exports

Technical support & IPR strategy

• Provision of technical expertise on European GNSS infrastructure, systems, and signals for R&D, standardisation and certification activities to (a) support the development of equipment and services embedding European GNSS specific features and promote and foster the uptake of specific European GNSS features such as ionospheric models, longer code, authentication and EGNOS Data Access Service (EDAS)

• Availability of laboratories and technical experts to support application developers

• Continuous monitoring of technology state-of-the-art in all technologies related to GNSS applications (e.g. signal processing, clocks)

• Establishment of an IPR Policy preserving European industry interests and guaranteeing reciprocity with other GNSS constellations and associated services

Availability of necessary skills

• Encourage universities and other educational and research institutions in Europe to strengthen their activities within GNSS technology in support of industry

Support to research & development

• Public institutions must contribute to the R&D effort for:

– Key enabling technologies, such as clocks, improved antennas or signal processing technologies for European GNSS receivers

– Critical technologies, applications and services based on end user requirements, such as reliability, robustness, security and high performance

• Address the GNSS application layer in complementary and efficient R&D programmes, such as Horizon 2020, Fundamental elements, Fast Track to Innovation at EU level or ARTES 3-4 and GSTP at ESA level which together provide the key to the development of the GNSS downstream sector

• Continuous open calls to encourage the emergence of innovative ideas and foster technology research, what ever the domain and the technology area

• Launch R&D calls for proposals on a yearly basis (Note the absence of FP7 GNSS applications R&D budget from 2011 to 2014 – the dedicated FP7 budget being exhausted due to extensive cuts leaving only EUR 100 million in the GNSS FP7 budget line, instead of the EUR 350 million agreed at the outset. Note also the EC plans to launch H2020 calls for proposals for Galileo applications R&D every two years.) to ensure continued innovation and market development

• Reduction of time to market, crucial in the innovation process, through for example:

– Fast procurement for R&D activities –maximum time limit of 4 months from the proposal submission to the contract signature

– Use of an Authorization to Proceed to allow the industrialists to start R&D at their own risk before the contractis awarded

• Simplification of the administrative burden of EU R&D programmes, which many consider are extremely time and resource consuming or even discouraging, in particular for SMEs

• Importance to clearly place IPR under the control of the proposer in all R&D Programmes Standardisation, certification, testingfacilities

• Support to the standardisation work in relevant domains as well as the certification process for safety/security critical applications, addressing in particular the specific features of European GNSS (e.g. authentication, robustness and security)

• To ensure the existence or facilitate the access to test facilities, particularly in strategic domains

• Update, replacement or augmentation of existing standards – implicitly based on conventional technology or GPS – with alternatives to facilitate and promote the use of Galileo and EGNOS

Demonstrations and operational pilot projects

• Setting up of Demonstrations and Operational Pilot Projects focusing on implementation of GNSS solutions tightly integrated in the real operational user workflow, involving all value chain actors, and highlighting EGNOS and Galileo differentiators

• Establishment and maintenance of a set of market-driven demonstration centres in cooperation with relevant market owners to enhance the adoption of European GNSS-based solutions and overall market penetration

Manufacturing capabilities

• Support to the development of manufacturing capabilities for strategic sectors

Specificcase of start-UPS and SMES

• Additional instruments specifically tailored to SME, like the EU SME Instrument to be contemplated, for instance:

– Fast procurement ‘purchase order type’

– Simplified payment plan with increased up-front payment

– Fast track for garage box innovative ideas

– Funding mechanisms to bridge the “valley-of-death” between the R&D step and the industrialisation/ market development leading to the with- drawal of many SMEs at the end of the R&D phase

– Innovative co-funding concepts for SMEs as a kind of Return On Investment (ROI) in case of commercial success

– Investors’ Fora while capitalizing on Pilot Customers’ first feedback on experience

– Dedicated support on IPR at the outset of a project: IPR intentions, status and ownership plans

• Need to pursue start-up financing and explore new co-funding concepts involving potential investors or customers

References

The proposals and discussions in this paper are backed up by the following publications of the European Commission and its Agencies, the European Parliament, the European Space Agency and Galileo Services:

• “European GNSS Programmes & European Transport Policy”, EC/GS Meeting, 2 October 2014, EC premises, Brussels

• “Necessity of a European industry policy to develop the European GNSS downstream sector”, ESAPB-NAV, 1 October 2014, ESA Headquarters, Paris

• GS position paper “Satellite Navigation Applications Realizing the Ambitions of EU 2020”, 2011

• “Manifesto for a more committed Europe towards the development of GNSS Applications”, 2010

• REG (EU) No 1285/2013 of 11 December 2013 on the implementation and exploitation of European satellite navigation systems

• GNSS Market Report, Issue 4, European GNSS Agency

• European Parliament resolution of 15 January 2014 on reindustrialising Europe to promote competitiveness and sustainability

• EC COM (2013) 108 “EU space industrial policy releasing the potential for economic growth in the space sector”, 28 February 2013

• EC COM/2010/0308 “Action Plan on Global Navigation Satellite System (GNSS) Applications”, 14 June 2010

The paper also has a concluding section “Galileo Services Forum” explaining the purpose and the plans of the forum. For further information: Axelle Pomies, Galileo Services Permanent Representative, axelle. pomies@galileo-services.org

(3 votes, average: 2.00 out of 5)

(3 votes, average: 2.00 out of 5)

Leave your response!