| Mapping | |

Indoor Maps – the new frontier of mapmaking

This paper examines the evolution of indoor mapping, the current trends in the sector and what the future holds for “the new frontier of mapmaking” |

|

|

|

|

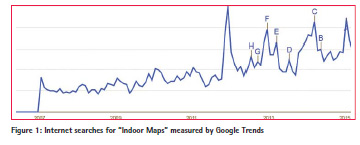

Less than a decade ago, few could have imagined that it would soon be possible to access detailed maps of indoor spaces on one’s desktop computer, let alone on one’s mobile phone. Interest and awareness of indoor maps is rapidly gaining pace, as are new technologies to support. In this piece, we’ll examine the evolution of indoor mapping, the current trends in the sector and what the future holds for “the new frontier of mapmaking”.

The rise of Indoor Maps

The rise of personal computers, and later the internet made it possible for maps to be consumed directly in Geographical Information Systems and within internet web browsers. An abundance of digital map layers and digital gazetteers have become available for use on personal computers. Consequently, digital maps have become a central part of everyday modern living.

These advances had a profound impact on our understanding of the world we live in, but were primarily focused on the “outdoor” world, and largely restricted to desktop-sized hardware.

Since the year 2000, the rise of lightweight pocket-sized personal digital assistants, palm- sized devices, and later smartphones and “wearables” such as smartwatches, made it possible for us to carry around detailed maps everywhere we go. This began to include indoor spaces, where we spend as much as 90% of our time.

This means that, over the past five years, mapmaking has soared beyond the boundaries of walls of buildings, penetrating deep inside complexes with multi-floor, room-level maps becoming available for shopping centers, airports, train stations and even hospitals and office buildings. This has once again raised the bar of digital mapmaking capabilities, and has also triggered a new level of expectations amongst consumers and businesses; expectations of ubiquitous, true-tolife representations of indoor spaces.

Notable trends in Indoor Mapping

Market Valuation

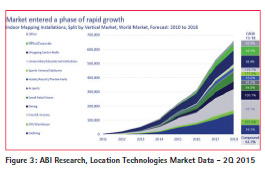

ABI Research recently forecast that Indoor Location will be a $4B global market by 2018. Meanwhile, Opus Research estimated that spending on indoor location hardware, services and license fees will amount to $1.6B in the USA alone by 2018.

In its Q2 2015 report, ABI Research stated that the Indoor Mapping market is entering a phase of rapid growth with indoor map installations poised to more than double from 250,000 locations in 2015, to over 650,000 locations globally, by 2018.

Market Trends and Catalysts

Retail Sector

Mobile applications powered by detailed indoor maps play an ever-increasing role in retail as traditional brick-and-mortar stores experiment with new ways to compete with online retailers such as Amazon.

According to Accenture 83% of shoppers have trouble finding what they’re looking for in physical stores, and 73% of shoppers with smartphones prefer to reference their smartphone while in-store rather than ask a sales associate.1 Smartphones with detailed store maps are starting to appear to help shoppers find their way around stores, and ensure they find all the products they seek.

Retailers are also experimenting with more personal, contextually relevant deals and coupons, based on the shopper’s in-store location and behavioral patterns. In-store analytics on consumer behavior are giving retailers an unprecedented insight into dwell time and footfall, based on time of day. These location-based insights are helping retailers detect friction points in the shopping experience, for example when a shopper is hesitating to make a purchase. This allows them to incentivize their shoppers, sending them a deal at the right moment, to maximize chances of a purchase taking place.

Another important trend in the battle with online retailers is centered on offering customers the ability to mix and match purchase channels and delivery options, a trend frequently referred to as “omnichannel retailing”. For example, 23% of leading UK retailer John Lewis’customers now research online before making a purchase in one of its local stores.2 This online to offline retail trend is gaining pace as stores strive to exploit their widespread physical presence on the high street, with the ability to offer faster, more convenient local fulfillment options; a luxury not available to large online rivals such as Amazon. Once instore, customers can collect the items they ordered, and are incentivized to browse for further items with immediate in-store only deals, often valid only on the day of their visit.

Detailed store maps guide shoppers around the stores, highlighting deals and items that match the user’s profile. US retailers Macy’s, Target and Meijer are all building location-enabled apps to help further capitalize on this growing trend. Others will follow their lead.

Travel Sector

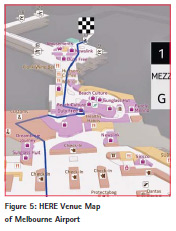

In the United Kingdom, a CPP research study found that 41% of UK holidaymakers have struggled to find their way around foreign airports. 20% of travelers have had to run to the gate with minutes to spare.3

As airports and train stations strive towards ever climbing KPIs on traveler throughput, they are increasingly turning to locationaware solutions to identify bottlenecks and optimize the flow of passengers.

Copenhagen Airport recently partnered with Cisco to offer passengers an indoor positioning-enabled mapping application, with “turn by turn” guidance and detailed maps to help explore the airport and identify facilities, stores and local offers. “We can also monitor and prevent potential choke points. That means passengers spend less time queuing and more time doing the things they want, like dining and shopping.” — Jan Zacho, Sector Manager, Infrastructure and Telephony, Copenhagen Airport.

Similar travel solutions are increasingly being developed by leading airports, airlines and rail operators around the world.

Internet of Things (IoT)

Yole Développement predicts the annual value of the overall IoT market in 2024 will be $400 billion with $46 billion coming from hardware, $59 billion from cloud infrastructure and $296 billion from data processing services.4 Physical objects or “things” are increasingly being embedded with electronics, software, sensors and network connectivity.

When combined with indoor maps and indoor positioning, this opens up a powerful new set of asset tracking and resource optimization opportunities for businesses. For example, it becomes possible to accurately track movable assets such as costly hospital equipment, specialty tools on the factory floor, mobile robots or even livestock.

Manufacturing

Factory floors are often large and widely spread out. When parts or tools go missing or are stored incorrectly, this can lead to major production line disruptions and productivity bottlenecks. Such disruptions are particularly taxing when they relate to costly tools that are in short supply. To address these challenges, new manufacturing solutions are being developed, that utilize ultra-wideband (UWB) sensors and wireless transmitters to locate people and assets such as tools or parts to within 20 cm. For example Ubisense, a leading provider of Enterprise Location Intelligence solutions, claims to have already installed over 6,000 sensors and 22,000 tags to assist with indoor asset tracking at over 50 manufacturing facilities worldwide. Ubisense customers include Airbus and some of the world’s largest automobile manufacturers such as BMW and Volkswagen Group. “Ubisense Smart Factory is specifically engineered to deliver unprecedented visibility of manufacturing processes and provide critical insights by using real-time location data to monitor operations”.5

With around half a million factories in the United States alone, Ubisense and its competitors in this space (including ABB, Bosch, GE, and Rockwell Automation) are only scratching the surface of the overall opportunities for IoT in the manufacturing industry.

Warehousing and Logistics

Large warehouse operations today typically track thousands of goods and moving parts. Any small inaccuracies and loss or spoilage of goods can quickly impact productivity and amount to sizable costs. This makes warehousing an ideal environment for IoT applications.

According to DecaWave, it is now possible to “monitor customers’ stock levels, warehousing, distribution and shipping to within 10cm in real time”.6

In Germany, Aletheia, a leading innovation project funded by the Federal Ministry of Education and Research is testing a real-time positioning system that uses energy-efficient wireless communication to continuously monitor the position, condition and delivery state of goods as they move through the supply chain.

Nonetheless, according to DHL, we are today “just at the tip of the iceberg of fully exploiting IoT potential in the logistics industry”.7

Healthcare Industry Today an average-sized hospital carries 8,000 stock keeping units (SKUs) of in-house inventory at any one time, and may “own” as many as 35,000 SKUs end to end. Supply chain costs consume as much as 40% of total operating budget, the second-largest expense for hospitals after labor. 8

By 2020, supply costs will likely surpass labor costs as the biggest expense for health systems.9 Consequently, even small efficiency savings in supply-chain performance can have a sizable impact on a hospital’s bottom line. For example, it is estimated that on average 30% of nurses report spending at least one hour per shift searching for equipment.10

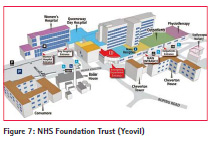

With a combination of detailed indoor maps, indoor positioning, and asset tracking tags, hospitals can achieve sizable efficiency savings and potentially save lives, by tracking costly movable equipment, for instance dialysis machines, infusion pumps, or emergency ventilator machines, and ensuring these can quickly be found when they’re needed the most. In 2013 Kingston Hospital NHS Foundation Trust rolled out a Cisco Smart Solution to help manage and protect hospital assets by pinpointing their location to within 3m.11

Indoor location technology can also help track hospital staff and patients, to ensure the nearest appropriate staff member is called to an emergency as soon as it arises. Further usages include ensuring each patient is checked on time by the appropriate staff member, and ensuring staff are regularly using hand-washing stations. In the United Kingdom, 6.9 million outpatient hospital appointments are missed each year amounting to a total cost of around £700m per year.12 The Guardian newspaper states13 that a significant proportion of missed appointments are the result of navigation problems, especially at large hospitals. The Wall Street Journal states that “visitors struggle to navigate the maze of the modern medical complex”. Confusing layouts and signage add to patients’ anxiety at a time when many are feeling ill and are coming to the hospital to undergo tests and procedures”.14

In spite of these costly challenges, at the time of writing (August 2016) usage of indoor location technology within the healthcare industry remains in its infancy. This presents a major opportunity to suppliers of indoor mapping, indoor positioning and asset tracking solutions.

Automotive sector

In-dash navigation systems have in the past been limited to largely static map data, with little or no internet connectivity. More recently automobile manufacturers have begun connecting cars, by means of built-in SIM cards, as well as via Bluetooth/ Wi-ficonnected smartphones. This has triggered a new trend; the rise of so called “car companion apps”. These serve multiple functions including intelligent services such as Telediagnostics, Breakdown Management, Accident Recovery and general car Maintenance Management. They also assist drivers by storing the location where they park, and even permit the exchange of destinations and waypoints directly with their car. These companion applications also now increasingly include functionality to guide drivers to their final destination on foot, after parking their car. This is frequently referred to as “last mile” routing.

While many car manufacturers now offer mobile apps with last-mile guidance, at the time of writing (August 2016), none of these included detailed pedestrian instructions inside of venues such as malls, airports and train stations. Such functionality is however starting to come to fruition on the latest models of Personal Navigation Devices (PNDs) such as the Garmin’s latest devices. Drivers will increasingly start to expect car companion apps to offer a similar level of local last mile guidance, to indoor destinations.

Car manufacturers are also starting to experiment with detailed (centimeter-level accuracy) maps of parking garages. Such parking space-level maps will increasingly be required to support advanced use cases such as autonomous valet parking.

References

1 http://www.accenture.com/ SiteCollectionDocuments/PDF/ Accenture_2010_Retail_Study_ Retailing_in_an_Era_of _Mobility.pdf

2 http://www.johnlewis.com/inspirationand- advice/home-garden/jl-retail-report

3 http://www.prnewswire.co.uk/ news-releases/four-million-britonsgive- up-flying-dueto-airportstress- 145288945.html

4 http://www.analog-eetimes.com/en/yolepredicts- ic-price-pressure-in-iot- roadmap. html?cmp_id=7&news_id=222906434

5 http://ubisense.net/en/information/ resources/smart-factory-resources/ ubisense-gives-airbus-unprecedentedvisibility- global-logistics-boostproduction- efficiencies

6 http://www.decawave.com/ markets/warehousing-logistics

7 http://www.dpdhl.com/content/ dam/dpdhl/presse/pdf/2015/ DHLTrendReport_Internet_of_things.pdf

8 Darling M and Wise S. (2010) Not Your Father’s Supply Chain. (2010) Materials Management in Health Care. 2010 Apr;19(4):30-3

9 Strategic Supply Chain Management (2011). Hospitals and Health Networks

10 Meade, CM (Spring 2007). Round bounty. One-hour positively influences patients and nursing staff members. Studer Alliance for Health Care Research. Available at http://www. ncbi.nlm.nih.gov/pubmed/17396681

11 http://www.cisco.com/c/dam/en/us/ products/collateral/security/identityservices- engine/kingston_hospital_v7cs.pdf

12 http://www.thetimes.co.uk/tto/ health/news/article4366828.ece

13 http://www.theguardian.com/ healthcare-network/2015/mar/05/losthospitals- costs-nhs-patients-navigation

14 http://www.wsj.com/articles/ SB1000142405270230374360 4579355202979035492

(1 votes, average: 4.00 out of 5)

(1 votes, average: 4.00 out of 5)

Leave your response!