| Disaster Management | |

Recovery from Disaster – The Canterbury Earthquake Sequence

How professionals have helped to prevent recovery in Canterbury and have caused a separate disaster for property owners |

|

|

The city of Christchurch, New Zealand, has suffered over 10,000 earthquakes since the M7.1 earthquake which occurred on 4th September 2010.

It has been stated that New Zealand has one of the highest rates of insurance for natural disaster damage in the world, however, 5 years after the first earthquake in September 2010, many Christchurch homeowners are no further forward with the settlement of their earthquake claims. Many are unhappy with the professional assessments carried out on their homes, questioning both the assessment of earthquake damage and the proposed repair strategy.

Professionals carrying out damage assessments have routinely used the incorrect standard for both assessment and the repair of the earthquake damage.

This paper provides a review of the last five years in Christchurch and suggests that Professionals have caused a new disaster for homeowners – a “Professionally Induced Disaster” with this disaster having a more detrimental effect on homeowners than the effects of the actual earthquakes.

Introduction

Christchurch, New Zealand.

A city that for many of its residents, the phrase ‘Recovery from Disaster’ is simply not a reality. A city where many of it’s homeowners are in the midst of a new disaster caused by the incorrect assessment of earthquake damage. Where professionals are assessing and scoping repairs to damaged homes without considering the standards stated in the legal insurance contracts.

The terms ‘Recovery from Disaster’, ‘The Rebuild’, and ‘Resilience’ abound in Christchurch. However, for many homeowners these words have no meaning to either their homes or their lives.

At the time of writing this paper (February 2016) it is over 5 years on from the terrifying M7.1 earthquake which struck at 4:35am on 4th September 2010. It is one week from the fifth anniversary of the M6.3 earthquakes that struck at 12:51pm on 22nd February 2011 with the resulting loss of 185 lives. An earthquake that had measured vertical acceleration of 2.2g, one of the highest ever recorded earthquake accelerations.

98% of residential homes in Canterbury had insurance cover for earthquake damage, with the majority of homes having the standard of reinstatement for damage being full replacement, new for old, with no upper limit to the sum insured.

The EQC Act1 and the various private insurance contracts that homeowners had in place at the time of the earthquake defined both the loss and damage that was insured and the standard of reinstatement of that damage.

Why is it, that after 5 years, professionals (including surveyors, structural engineers and geotechnical engineers) are using the incorrect standard for the determination of damage, and the incorrect standard for the repair of this damage?

This paper explores what has actually occurred in Christchurch; the disaster that has occurred for many homeowners due to professionals not understanding both their professional duties, but also the legal requirements in assessing earthquake damage when private insurance policies exist.

A ‘professionally induced disaster’

This is a story about a new disaster in Christchurch. A ‘Professionally Induced Disaster’ that has affected tens of thousands of Christchurch homeowners, and has prevented these homeowners from participating in any recovery.

The FIG2016 conference theme is “Recovery from Disaster.” The FIG website states:

“In spite of the disastrous swarm of quakes, Christchurch remains fully functional and repairs to essential service infrastructure have largely been completed… Suburbs, particularly those to the north, south and west, are experiencing a boom and visitor attractions out of the city centre are unaffected.”2

It also states:

“Surveying and spatial professionals are key actors in making an important contribution to improve, simplify and shorten the disaster mitigation, rehabilitation and reconstruction phase.”3

The evidence in Christchurch shows that the various ‘actors’ have not improved, simplified or shortened the disaster rehabilitation for many homeowners. To the contrary, their assessments have caused significant delays in the settlement of earthquake claims, with many homes being left with significant damage totally unrepaired. This has resulted in homeowners living in significantly damaged homes while they spend what funds they have to obtain their own expert reports.

While Christchurch cannot be held as a model for ‘Recovery from Disaster’, it can be used to show the moral, ethical and professional deficit that is prevalent throughout professions in New Zealand.

A candid appraisal of what has occurred in Christchurch to date will hopefully help prevent a similar ‘Professionally Induced Disaster” from occurring elsewhere in the future.

The media’s headlines

The New Zealand media paints a rather disturbing picture about the ‘Recovery from Disaster’ in Christchurch, with headlines such as:

“Damage specialist warns of ‘catastrophe’ for homeowners.”4

“‘Questionable Methods’ used by EQC, says surveyor.”5

“EQC floor test ‘unreliable, non-expert.’”6

“Study backs homeowners on floor flaws.”7

“More than 6500 homes need fix after faulty EQC repairs.”8

“Engineers leaving reports ‘unsigned’.9

“Government’s ‘dogged determination’ to deny mental health problem in Canterbury.”10 29 December 2015.

“Earthquake stress triggers mental health issues.”11 25 May 2015.

“Attempted suicides highest in Canterbury, twice as much as Auckland.”12 20 January 2016.

Natural disaster insurance in New Zealand

The Earthquake Commission (EQC) and Private Insurance

EQC is a Crown entity which administers insurance against natural disaster damage provided under the EQC Act.13

The cover provided by the Act is akin to that offered by private insurers.14

Section 18 of the EQC Act outlines the insurance provided by EQC for natural disaster damage, which states that if a person enters into a contract of fire insurance with an insurance company for a residential building, then EQC is liable for up to the $100,000 (excluding GST) in respect of each earthquake event. This amount is commonly called the ‘cap’.

The private insurance contract is, in effect, top-up insurance cover for loss or damage not covered by EQC. If the cost of reinstatement of the earthquake damage is less than the $100,000 cap, then the private insurer is not involved with the claim, and EQC either repair the damage or cash settle the claim with the homeowner. It is only if the reinstatement cost is above the EQC cap, that EQC would pay the cap amount, and the claim would be forwarded onto the private insurer.

This statutory scheme of insurance can be seen as providing a first layer of natural disaster damage (which includes earthquake damage), with a second (or excess) layer being the private insurance policy taken out by the homeowner. A homeowner is therefore able to insure a property for full replacement value, noting that the private insurance policy need not contain the same terms or provide the same protection

In Christchurch approximately 15% of all earthquake damage claims have been over the EQC cap of $100,000 and have been passed onto the private insurer. That is, 85% of the residential earthquake claims have remained undercap and with EQC.

Standard of Reinstatement – The Terms of the Legal Contract

Both the EQC Act and the private legal contract between the Insured (the homeowner) and the Insurer define both the damage covered by the insurance, and the standard of reinstatement of that damage. As Tim Grafton, Chief Executive of the Insurance Council of New Zealand outlined in a presentation delivered 19 February 201515:

“Insurance 101

Insurance exists to protect your possessions against unforeseen loss or damage

Risk transfer – you pay an annual premium to transfer risk to insurer, the money is pooled from which insurers pay for losses suffered.”

EQC Reinstatement Standard

EQC through the Earthquake Commission Act, provides cover for both residential homes and land.

In simple terms, the Act provides replacement cover to “a condition substantially the same as but not better or more extensive that its condition when new..”16

This is also complimented by the requirement that EQC “shall not be bound to replace or reinstate exactly or completely, but only as circumstances permit and in a reasonably sufficient manner..”17

The Act defines both what natural disaster loss and damage is covered, and the standard of replacement of that damage.

The wording “substantially the same as but not better or more extensive than its condition when new” is critical in understanding the standard to which the repairs or replacement should be carried out to.

Private Insurers Reinstatement Standards

It has been commonly stated that there were around 100 different insurance policies in place at the time of the Canterbury earthquake sequence. Each of these insurance policies had different terms and conditions with the reinstatement standard varying greatly. Some policies were based on indemnity (e.g. the market value of the property at the time of the loss), while others provided for full ‘new for old’ replacement with no upper limit as to the cost to achieve this. The vast majority of the insurance claims that the writer has been involved with are the full replacement, new for old type reinstatement standards.

Some examples of the wording in these contracts are:

• “We will pay to repair or rebuild your house to an ‘as new’ condition.”

• “We pay the costs actually incurred to repair or rebuild it [the house] to substantially the same condition and extent as when it was new, or at our option the cash equivalent.”

• “We will pay the cost of restoring [the home] to a condition as nearly as possible equal to its condition when new using current materials and methods…”

In these examples, the reinstatement standard is to ‘as new’ or ‘when new’ type standard, rather than a depreciated standard.

The assessment and reinstatement strategy disaster

What has occurred in Christchurch, and what has been replicated in thousands of homes throughout the region, is people carrying out damage assessments and reinstatement strategies in which they were either not properly qualified to carry out, or they did not know what standard they were both assessing to and reinstating to.

Homes that have suffered severe settlement that have rendered them with critical flooding issues have been assessed by people who have simply not understood, and not measured the building settlement and the impact that this has on the structure. There are thousands of homes in Christchurch (probably tens of thousands) that have had critical building settlement (over 500mm in height in some cases) that has simply been ignored. Repair strategies have been prepared that have ignored raising the building to either it’s height “when new” or “as new” and have left the building in a floodprone state with the prospect of losing future flood insurance. This has occurred in many instances where there was a legal contract requiring the house to be reinstated to a condition of “as new”.

Many homes have been assessed for structural damage by people with absolutely no expertise in structural engineering. Severe foundation damage and superstructure damage has, in many cases, been totally overlooked due to the person carrying out the assessment not having the correct expertise to identify the actual damage.

Where there is a legal contract of insurance, the persons involved with assessing earthquake damage and determining the appropriate reinstatement strategy should carry out two important things:

1. Determine all of the loss and damage that has occurred due to the earthquake which is covered by the legal contract of insurance, and

2. Determine a reinstatement strategy that meets the standard set out in the legal contract of insurance.

Critical to these two steps is having a clear understanding of what loss or damage is covered by the EQC Act and private insurance contract, and also a clear understanding of the standard of reinstatement required.

It seems ludicrous that a person, without the required expertise, could visit a house to both determine the loss and determine a reinstatement without knowing, or understanding what the actual required legal standards are.

These two steps require a multitude of professionals and experts, including (but not limited to): Measurement experts (Surveyors) to accurately map the buildings and land. This would include measuring floor tilt and superstructure leans, lateral spreading and stretching, building and land settlement;

• Geotechnical Engineers to determine the ground conditions on and around the site;

• Structural Engineers to determine the structural damage to the building, and to determine what structural reinstatement is required;

• Builders and other trade professionals (drainlayers, electricians, plumbers, etc.) to determine the damage to the building ‘fabric’;

• Weather-tight specialists to determine whether the earthquakes have caused the building weathertightness to be compromised.

All of these experts and professionals have expertise and specialties in certain areas. It is most unlikely that one particular expert will have expertise in all of these areas.

For instance, the builder or plumber would not have the required expertise to assess and scope the structural elements. The structural engineer is unlikely to have the expertise to assess damage to the electrical wiring. The electrician is unlikely to have the expertise to carry out the swathe of complicated and accurate survey measurements of the land and buildings required to determine the various parameters of the damage.

Whose Responsibility is it to ‘Prove the Loss’?

Various High Court Judgments have clearly indicated that it is the job of the Insured (that is, the homeowner) to ‘prove the loss’.

In order to correctly ‘prove the loss’, the homeowner would require probably around at least $50,000.00 of expert reports, ranging from geotechnical engineers, surveyors, structural engineers, weather-tight experts, lawyers, builders, quantity surveyors, to name but a few.

The average insurance excess for a claim in 2010 would have been less than $1,000, however, in reality, a further $50,000 may be required to obtain the necessary information to ‘prove the loss.’

Typically, the first assessments have been carried out by both EQC and the private insurers with the homeowner then obtaining their own professional assessments if they find they do not agree with these assessments.

The vast majority of assessments that have been carried out by persons acting for EQC, the private insurers and the homeowner have used the incorrect standards for their assessments and reinstatement strategies. These assessments and reinstatement strategies have typically been carried out to no defined standard, or to the ‘standard’ setout in the ‘MBIE Guidelines’.

It is noted that the writer is aware of a small minority of assessments carried out by EQC and various insurers where the standard in the legal contract or Act was used by the professionals. This has resulted in the earthquake damage being correctly determined, a reinstatement strategy being correctly calculated, and the earthquake claim quickly settled.

The ‘MBIE guidelines’

Shortly after the 4th September 2010 the Government’s Department of Building and Housing (the DBH, which is now the Ministry for Business, Innovation and Employment (MBIE)) issued Guidelines titled “Repairing and rebuilding houses affected by the Canterbury Earthquakes.”

The MBIE Guidance was issued under Section 175 of the Building Act 2004. Guidance issued under Section 175 is for the sole purpose of assisting persons to comply with the Building Act. It was not issued to assist persons to comply with the EQC Act or private legal contracts of insurance.

The paradox with the MBIE Guidance is that the Building Act does not outline, or mandate any assessment standards or repair standards for earthquake damage, yet, the MBIE Guidance (which was issued solely to assist persons to comply with the Building Act) outlines indicator criteria for floor dislevelment, wall leans, cracks widths, and many other areas of damage. It also outlines suggested repair strategies for this earthquake damage. In essence, the MBIE Guidance suggests standards and procedures that are not contained within the Building Act, which indicates that the Guidance may not have been solely issued to assist persons to comply with the Building Act.

This MBIE Guidance was issued to address three areas of earthquake damage:

1. Assessment criteria, or assessment indicators for earthquake damage;

2. Suggested repair standards, or repair strategies for earthquake damage; and

3. Suggested foundation design for new foundations in both areas of liquefied ground, and on the slopes of the Port Hills. (The foundation rebuild strategies outlined in the Guidance are generally considered robust and are therefore not addressed in this paper).

Section 112 (and 42a for building consent exemptions) of the Building Act outlines the required standard for repair work, with this standard being that the area of repair work needs to comply with the Building Act and Building Code, however, as long as the rest of the building does not comply to any lesser extent than it did immediately before the repair work commenced (note: not before the earthquake damage occurred), then the repair work would meet the requirements of Section 112, and therefore the Building Act.

For assessments and repair of earthquake damage under both the EQC Act and the private insurance contract, the standard of reinstatement is significantly higher than what is required in the Building Act and MBIE Guidance. That is, the MBIE Guidance is by definition, created to a lesser standard than the EQC Act and most private insurance contracts require.

Therefore, using the MBIE Guidance for the purpose of assessing earthquake damage and for a repair strategy will most likely result in the building not being returned to an ‘as new’ or ‘when new’ condition.

The MBIE Guidance has been used almost universally as the ‘standard’ for assessment in earthquake claims involving both EQC and private insurance contracts, even though legally, it is not the correct standard.

There is an argument that the MBIE Guidance could be used as the correct standard if the expert (e.g. structural engineer) provided proof, calculations and rational analysis that it did meet the reinstatement standard in the insurance contract, however, to date no such proof has been seen.

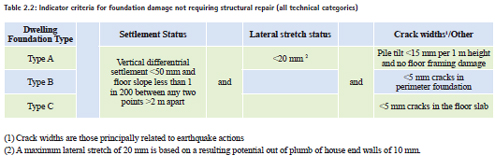

Example: Table 2.2 of the MBIE Guidance – Criteria for ‘No Foundation Damage’

Table 2.2 of the MBIE Guidance is commonly used a the ‘standard’ for determining whether there has been any structural foundation damage to a house.

These indicator criteria for a concrete slab on grade house states that if the total floor height difference is less than 50mm in height, with all floor slopes less than a grade of 1 in 200, with lateral stretch of the slab less than 20mm, and any slab cracks less than 5mm in width, that no structural repair is required or indicated.

In many cases, Table 2.2 has been used as a justification that a house is not structurally damaged. However, it has been shown repeatedly that by carrying out a detailed and accurate survey assessment, followed by a structural engineering assessment, that critical structural damage has occurred to the house.

For instance, a very common area of damage in the flat areas of Christchurch prone to liquefaction18 is for the building to suffer from Localised Settlement, that is, settlement of the house into the ground on it’s own footprint. This damage may not be readily seen, however, there are many instances where the floor dislevelment in a house has been less than 50mm in height, with no slab cracking, yet, it has suffered around 100-200mm of Localised Settlement.

This in most cases is critical damage, as it results in the house sitting in a localised depression, with underground services flowing uphill, and with surface water flowing towards the house rather than away from the house. In almost every case where this has occurred, the only suitable method of reinstatement to ‘as new’ is to lift the house up to at least it’s original height. Yet, this area of damage has been overlooked in thousands of Christchurch homes by the use of the MBIE Guidance and Table 2.2.

Survey assessments of earthquake damaged homes

Arguably the most useful (and misused) survey instrument in the whole Canterbury Earthquake saga has been the hydrostatic altimeter. This instrument was extremely useful for floor level surveys immediately after the 22nd February 2011 earthquake when the Central Business District of Christchurch was cordoned off as a ‘Red Zone’.

The hydrostatic altimeter allowed for the surveying of floor levels in buildings which conventional surveying would be almost impossible. Many of the CBD Red Zone buildings were critically damaged, with collapsed walls, partitions, ceilings, stairs and roofs. Furthermore, the lack of electricity required many surveys to be carried out in the dark, and for basement surveys – waist or chest deep in water. The altimeter was an ideal instrument to use in these adverse conditions.

As the use of these altimeters became common-place, it opened the door for a new breed of surveyor: those with no knowledge of actual surveying, no knowledge of the concepts of error mitigation, error propagation, independent checks, and so forth. It allowed for anyone to simply turn the instrument on and read a number on the screen.

The surveying of residential houses (and multi-storey multi-unit apartment blocks) was regularly carried out by people with absolutely no knowledge of surveying.

Errors were made. Large errors. Buildings with significant floor tilt due to earthquake damage were not surveyed correctly, and shown to be ‘level’. It was commonplace for these ‘surveyors’ to miss measuring in the critical areas of the floor, for instance, the highest and lowest floor levels.

The plans that these ‘surveyors’ prepared were by and large rough hand drawn sketches showing an array numbers on a floor layout plan that was not to scale. In many cases, measurements were not even recorded, with the only evidence being the note “the floor is level”.

The art, or profession of the Surveyor in New Zealand, with the ability to measure accurately, and then to show the measurements clearly on an accurately scaled plan, with contours, colours, slopes, gradients was mostly forgotten.

Unfortunately, the New Zealand Institute of Surveyors even implemented a one hour ‘training’ session for these new ‘surveyors’ in order to teach them how to use these altimeters.

The 9-10 years’ university training and post-graduate work, exams and assessments to become a Registered Professional Surveyor, became redundant when a two-hour training session provided the same expertise.

The surveying of earthquake damaged homes is not easy. It requires expertise and an understanding of construction and building to be able to know where to measure, and what to measure. There are many cases of even the best survey firms in Christchurch making gross errors in their precise level surveys of residential homes. If the most experienced surveyors can mange to make mistakes, it is clear that the person with two hours of training will not fare well.

The result of the ‘easy-to-use’ technology, and a survey profession reluctant to educate society on the expertise that only a surveyor possesses, has resulted in many damaged homes being accepted as not damaged, merely due to the insufficient survey work being carried out.

It is the writer’s belief that we, as professional surveyors, as measurements scientists, are the most well trained to undertake measurement in the real world and to represent these measurements in a way that the general public can understand.

This unique skill set that surveyors have should not be ignored. We have the ability to accurately measure real-life three-dimensional elements (for example, buildings) and represent the building as a series of plans and measurements in an easy to understand format.

This skill, expertise and accuracy has been sadly lacking as part of the damage assessments in Christchurch.

Christchurch 5 years on

Christchurch for many of its residents is a difficult place to live. The stresses of daily living, of working, family, finances, health, have been complicated by having to become experts in their own earthquake damage. Many homeowners have become insurance and engineering experts in their own right.

Many residents are still living in homes that are in their original damaged state from the 4th September 2010 earthquake. Many live in non-weather-tight conditions, with mould and rot invading their homes. Elderly people are having to walk around homes that have a 200mm height difference on their floors. Many have settled their earthquake claims in the belief that their home was not damaged, or had only superficial ‘cosmetic’ damage.

Thousands of Christchurch homeowners are still waiting in limbo for their insurance claims to be settled.

Thousands more Christchurch homeowners are now having to have EQC rerepair their homes due to the first round of repairs being incorrectly carried out.

Hundreds of home-owners have filed proceedings in the High Court and District Court in order to have what they believe their true legal entitlement realised. The High Court has become clogged with earthquake cases, with the simple task of going to trial requiring around a two year wait.

Many home-owners have become ill, either physically or mentally due to the stress of dealing with their insurance claims.

The publics perception of professionals (this would include structural engineers, geotechnical engineers, and unfortunately surveyors) has been significantly damaged over the last 5 years in Christchurch.

Christchurch is slowly rebuilding its inner city commercial and retail buildings, but for many homeowners, the prospect of a new, undamaged house is a distant dream.

Recommendations for the next earthquake

Professionals (including surveyors) involved in earthquake damage assessments, and reinstatement strategies need to make themselves aware of the legal contracts of insurance associated with a particular building.

If the legal contract of insurance defines the standard of reinstatement to be “as new”, then they need to assess and scope to “as new”, and not to a lesser standard.

Professionals (including surveyors) need to replace the mantra of “We work to the brief given to us by the client”, to that of working to standards of honesty, integrity, and objectivity.

If the brief given by the client is different to that in the legal contract, the Professional needs to query and not blindly follow the instructions given.

Professionals (including surveyors) need to be acutely aware of the people affected by their work. In the area of earthquake damage assessments, this includes:

• The Insurers (who are paying the cost of the repair or rebuild);

• The banks and financial institutions with mortgages over the property (they want their equity in the property retained);

• The homeowner (they also want their equity in the property retained). Sadly, for tens of thousands of homeowners, possibly hundreds of thousands, the experience they have had over the last 5 years would not be what they would call “Recovery from Disaster”.

For many, their experiences with the substandard assessments and reporting by professionals has left them with their own “Professionally Induced Disaster.”

Conclusion

The effects of incorrect and inadequate professional earthquake assessments will have a detrimental impact on many Christchurch residents for years to come.

It may well be that some people in Christchurch simply do not recover.

The “Professionally Induced Disaster” caused by the incorrect damage assessments and reinstatement strategies will affect homeowners in Christchurch for many years.

As professionals, we are required to act professionally, above and beyond the ‘brief’ of the client. We are required to act honestly, impartially, and objectively. To be aware of the people affected by our work, and to act accordingly.

The Christchurch lesson is a good lesson to learn. It is hoped that in future earthquake events, that Surveyors and other professionals will remember their professional and ethical duties.

Endnotes

1 Earthquake Commission Act 1993

2 http://www.fig.net/fig2016/theme.htm

3 http://www.fig.net/fig2016/

4 http://www.stuff.co.nz/ business/71112274/Damage-specialistwarns- of-catastrophe-for-homeowners

5 http://www.stuff.co.nz/the-press/ news/9017710/Questionable-methodsused- by-EQC-says-surveyor

6 http://www.stuff.co.nz/ the-press/news/christchurchearthquake- 2011/10570525/EQCfloor- test-unreliable-non-expert

7 http://www.stuff.co.nz/the-press/ news/10246566/Study-backshomeowners- on-floor-flaws

8 http://www.stuff.co.nz/the-press/ business/the-rebuild/73205717/ More-than-6500-homes-needfix-after-faulty-EQC-repairs

9 http://www.stuff.co.nz/ business/10578566/Engineersleaving- reports-unsigned

10 http://www.stuff.co.nz/the-press/ news/75161125/Governments-doggeddetermination- to-deny-mentalhealth- problem-in-Canterbury

11 http://www.stuff.co.nz/the-press/ opinion/68769392/Earthquake-stresstriggers- mental-health-issues

12 http://www.stuff.co.nz/national/ health/76060300/Attemptedsuicides- highest-in-Canterburytwice- as-much-as-Auckland

13 Earthquake Commission Act 1993, ss 4A and 5(1)(a).

14 Paragraph [21] Earthquake Commission v Insurance Council and Ors CIV 2014-485-5698

15 Presentation to the NZ Society of Local Government Managers, 19 February 2015

16 See definition of ‘replacement value’, EQC Act 1993

17 s9(1)(a) Schedule 3, EQC Act 1993

18 Liquefaction is the process in which the strength and stiffness of a soil is reduced by earthquake shaking or other rapid loading.

The paper was presented at FIG Working Week 2016, Christchurch, New Zealand, May 2 – 6, 2016

(2 votes, average: 3.00 out of 5)

(2 votes, average: 3.00 out of 5)

Leave your response!